PMEGP Loan Apply Online 2025: PMEGP is a scheme initiated by the government that helps individuals set up their own small and medium businesses. The Ministry of Micro, Small and Medium Enterprises governs this scheme. Its call to action is centered around creating employment opportunities for citizens in India, especially in villages and towns.

The PMEGP started in 2008 through the formation of the two older schemes: Prime Minister Rozgar Yojana and the Rural Employment Generation Programme. PMEGP provides loans to kickstart one’s business. Lower-cost loans are granted to make the process of establishment easy for all persons.

PMEGP has enabled many people to become entrepreneurs, such as artisans and youth looking for jobs. By way of creating jobs for locals, it helps reduce the rural-urban migration in search of employment. More on PMEGP will be covered in this article, including who are eligible for the program, how to apply, and its benefits for entrepreneurs.

- PMEGP Loan Scheme 2025 – Overview

- Key features of the PMEGP scheme

- Eligibility required for the PMEGP scheme

- Documents required for PMEGP Loan scheme Apply

- Financial Structure of pmegp loan jobriyababa

- How to Apply for PMEGP Loan Online

- Steps to Check Your PMEGP Loan Application Status

- FAQ's – About PMEGP Loan Application

PMEGP Loan Scheme 2025 – Overview

| article Name | How to Apply for PMEGP Loan Online |

| Scheme name | Prime Minister’s Employment Generation Programme (PMEGP) |

| Implementing Agency | Khadi and Village Industries Commission (KVIC) |

| Eligible Sectors | Manufacturing Sector (up to Rs. 50 lakh) and Service Sector (up to Rs. 20 lakh) |

| Beneficiaries | Individuals aged 18+, Self-help groups, Societies, Production co-operative societies, Trusts |

| Subsidy Rate | General Category: 15% (Urban), 25% (Rural); Special Category: 25% (Urban), 35% (Rural) |

| Loan Repayment | 3 to 7 years, post a moratorium period |

| Official Website | www.kviconline.gov.in |

Key features of the PMEGP scheme

- Subsidized Loan Assistance: Financial assistance in margin money subsidy for PMEGP is provided. Maximum project cost is Rs 50 lakh for manufacturing sector and Rs.20 lakh for service sector.

- Beneficiary Contribution: Contribution is 10% of the project cost in the case of applicants from the general category, while only 5% will be contributed by applicants of the special category.

- Higher Subsidies for Special Categories: Higher subsidy rates are provided to special categories including SC/ST/OBC/Minorities/Women and residents of NER, Hill, and Border Areas at the rate of 25% in urban and 35% in rural areas.

- Collateral-Free Loans: Up to the amount of Rs 10 lakh, this would be collateral-free loans, well supported by Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

- Second Loan for Upgradation: Existing PMEGP/REGP/MUDRA units can also avail of a second loan for upgradation with a subsidy of up to Rs 15 lakh for manufacturing and Rs. 3.75 lakh for services.

Eligibility required for the PMEGP scheme

- Age Requirement: Applicants must be 18 years or older.

- Educational Qualification: Minimum 8th standard pass for projects above Rs. 10 lakh in manufacturing and Rs. 5 lakh in the service sector.

- Eligible Entities: Includes individuals, Self-Help Groups (SHGs), Societies, Production Co-operatives, and Charitable Trusts.

- Project Type: Only new projects are eligible: existing businesses and units availing benefits under other government schemes are ineligible.

Documents required for PMEGP Loan scheme Apply

- Passport size photo of the applicant

- Detailed and professionally made project report or summary of the business

- Cast certificate, if you belong to the special category

- Aadhaar card

- Population certificate, duly attested

- Education certificates

- PAN card

- Residential address proof

- Business address proof

- Family income proof

- MSME registration

- Income Tax Returns of the past 3 years, if possible

Financial Structure of pmegp loan jobriyababa

| Category | Beneficiary Contribution | Subsidy (Urban) | Subsidy (Rural) |

| General Category | 10% of project cost | 15% | 25% |

| Special Categories (SC/ST/OBC, Women, Minorities) | 5% of project cost | 25% | 35% |

How to Apply for PMEGP Loan Online

Step 1. Visit the Official PMEGP Portal:

- Open the Khadi and Village Industries Commission (KVIC) website.

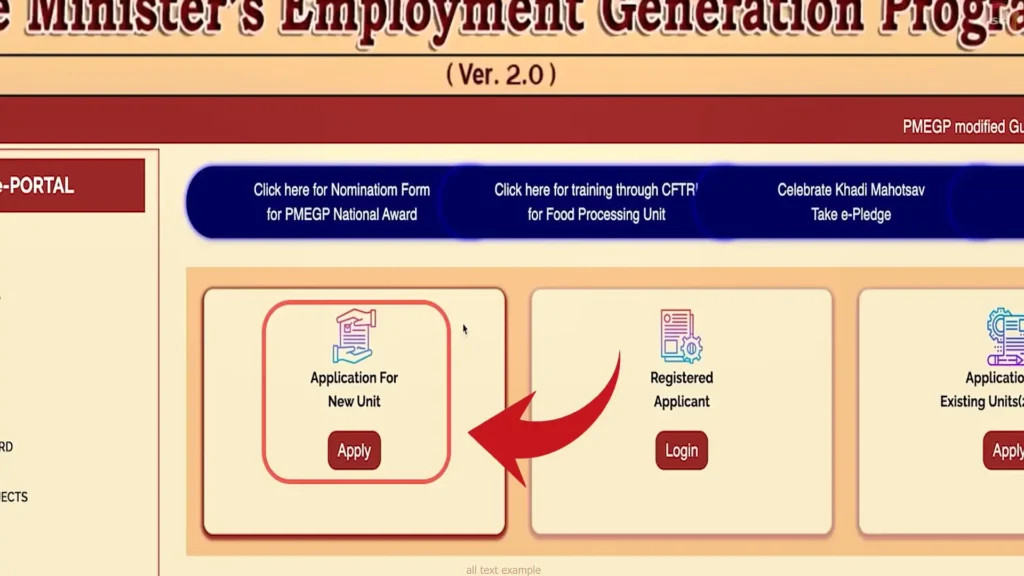

Step 2. Register a New Account:

- Click on “Apply” under “Application for New Unit.”

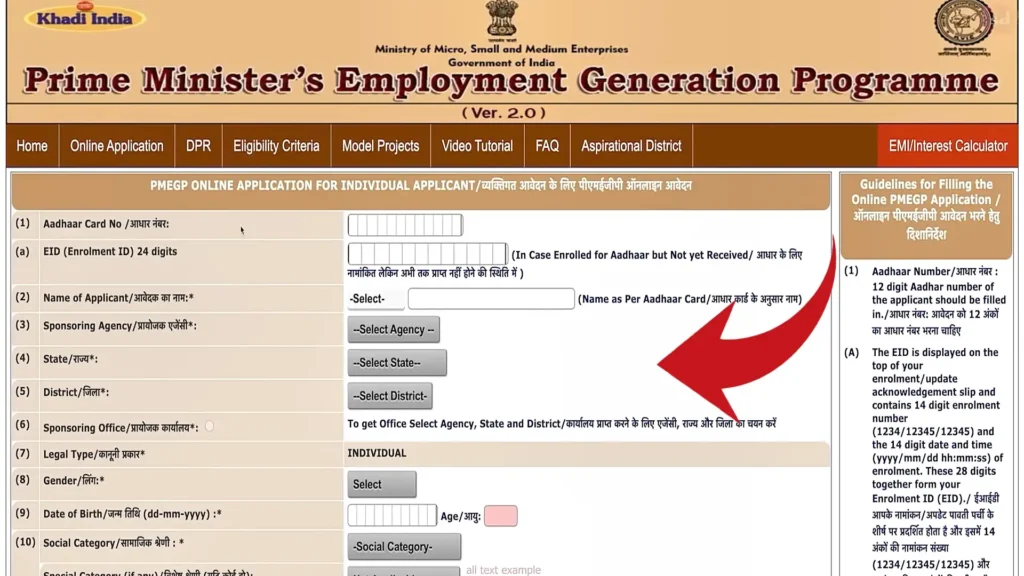

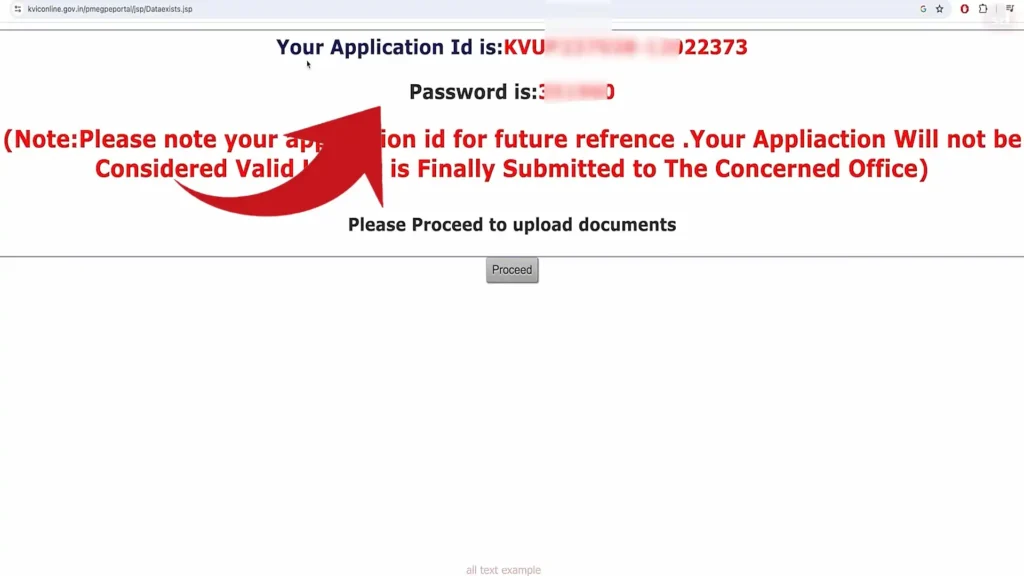

- Carefully fill in the registration form, without any mistakes, and save the information.

- Note down the Application ID and Password.

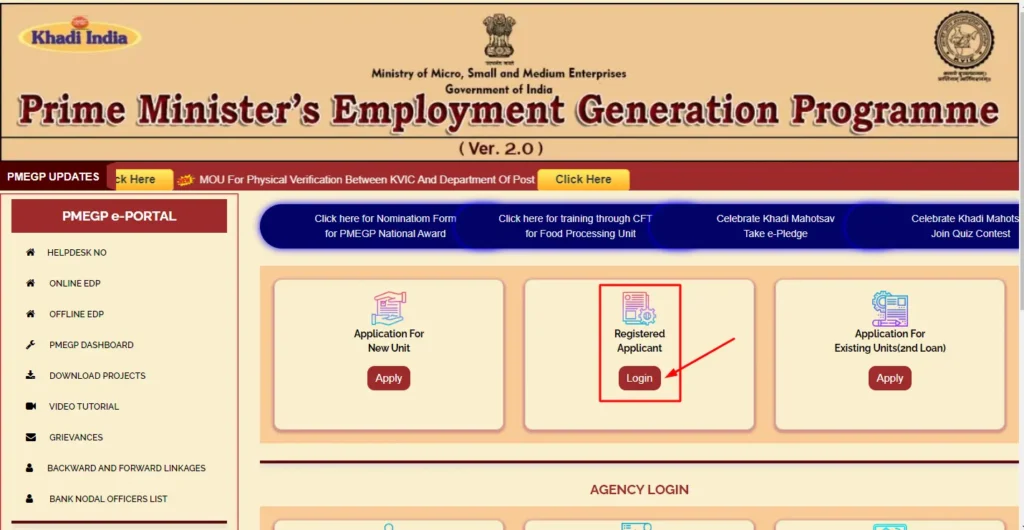

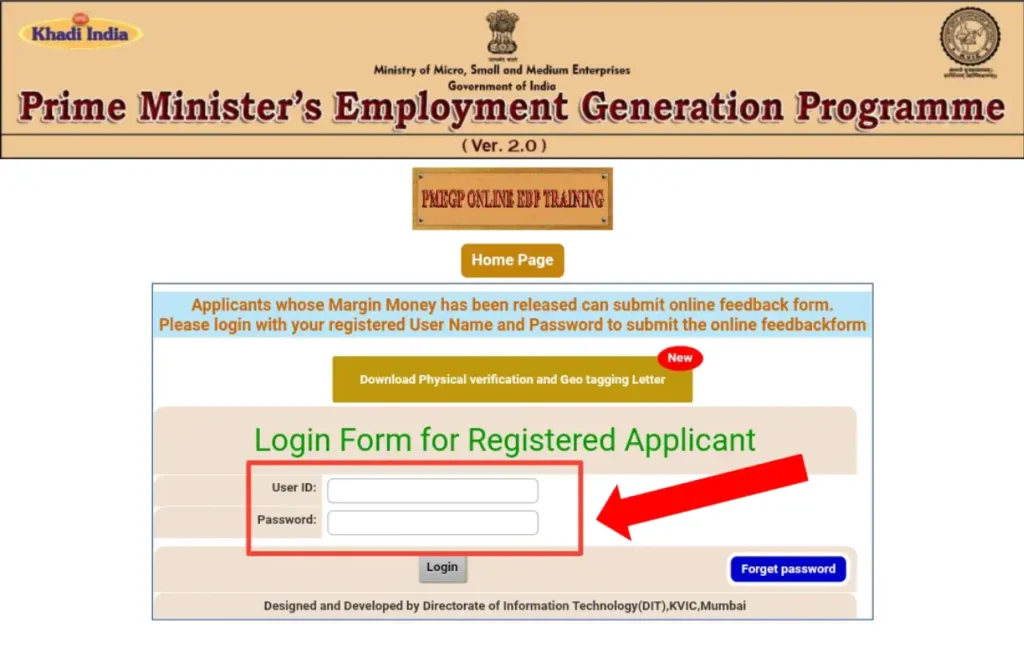

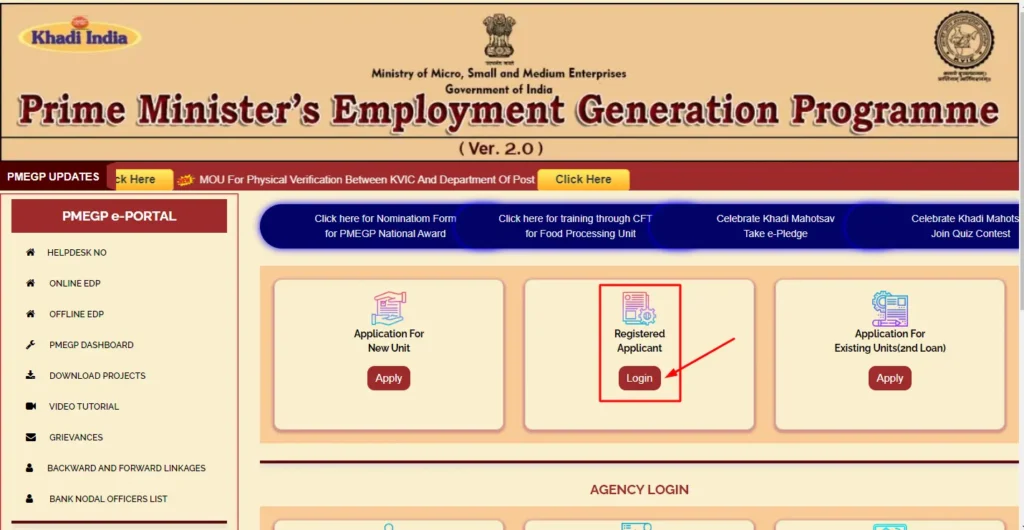

Step 3. Log into Your Account:

- Select “Registered Applicant (Login).”

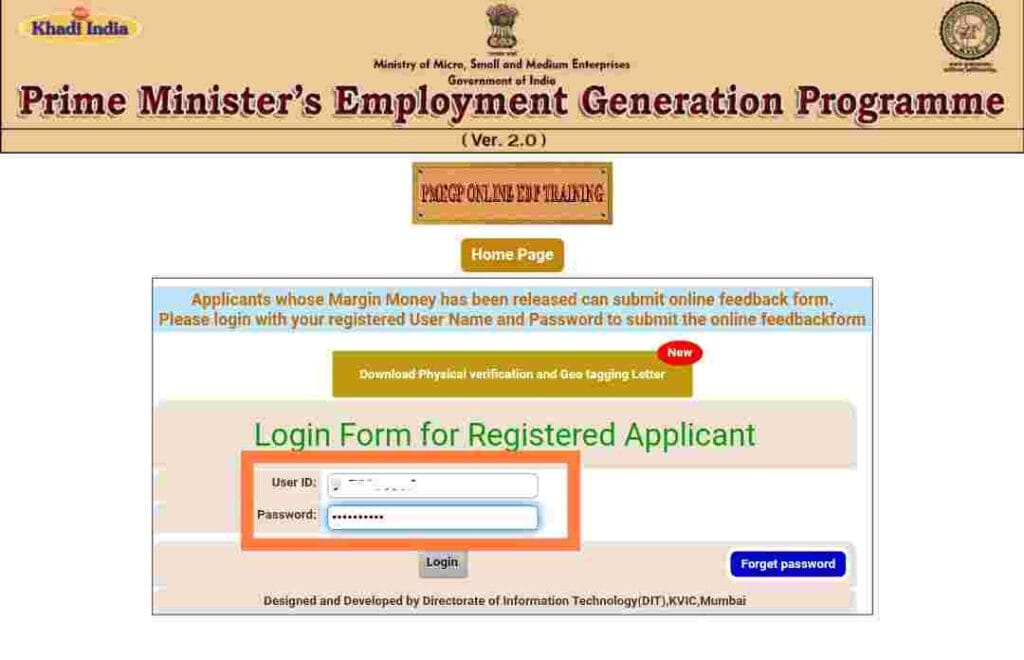

- Enter the User ID and Password.

- Click on Login to access the user’s dashboard.

Step 4. Fill the Application Form:

- All information on the application form should be filled in.

- Click on “Proceed” to move ahead and upload documents.

- Upload all the needed documents sequentially, that is, ID proof, project report, bank details, etc.

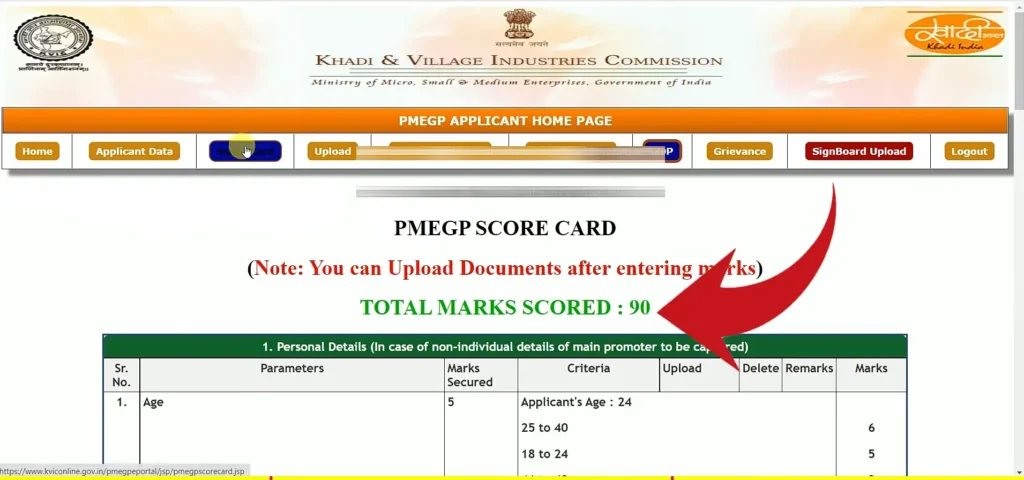

Step 5. Check the Eligibility Score Card:

- Click on “Score Card” to check your eligibility to get a loan.

- Answer all the questions and save your answers.

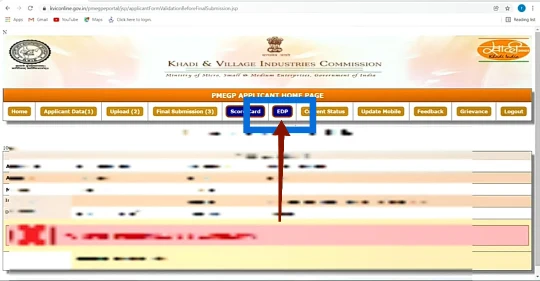

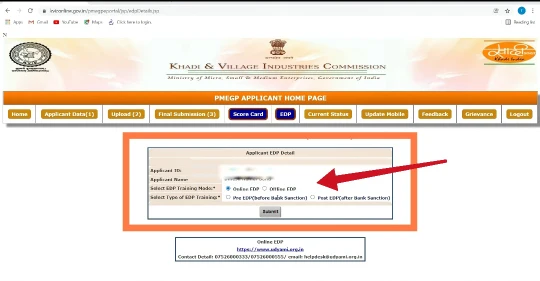

Step 6. Select EDP Training (if not done earlier):

- In the “EDP” section, select your chosen Entrepreneurship Development Program (EDP) training.

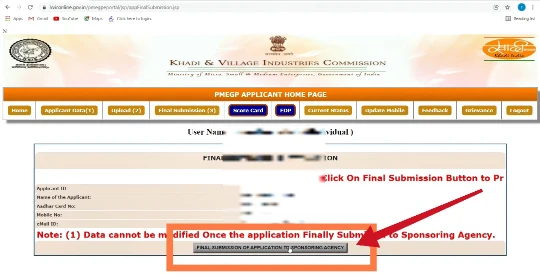

Step 7. Final Submission:

After all documents have been uploaded, select “Final Submission of Application to Sponsoring Agency“.

Step 8. Print and Submit to the Bank:

- After submission, click on “Print Application” to take a printout of your completed application form.

- Make photocopies of all the uploaded supporting documents.

- Go to the bank for which you applied and submit your application and supporting documents for processing.

Steps to Check Your PMEGP Loan Application Status

After sending off your PMEGP application, keep in check with it every now and then. Here is a straightforward way to keep track of it:

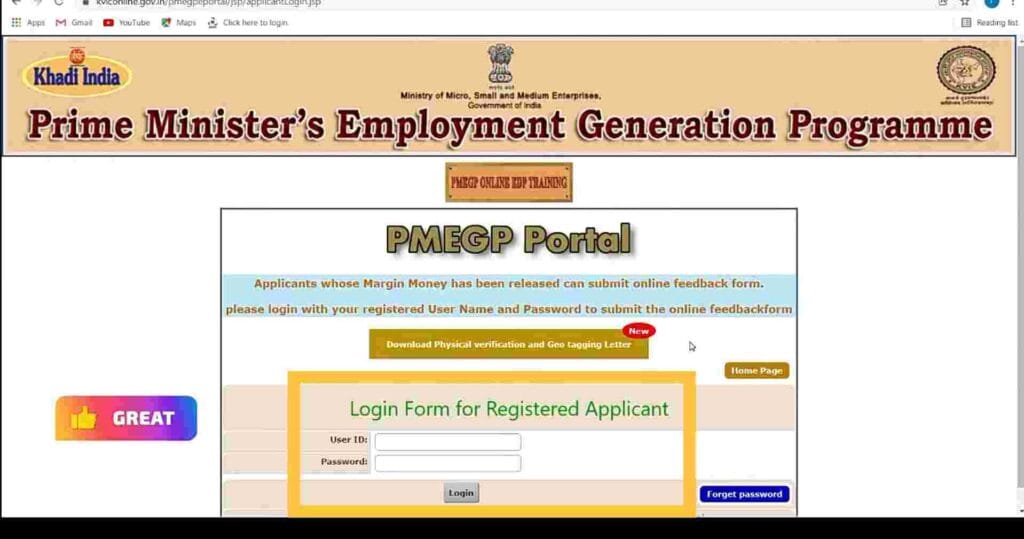

- Step 1. Head to the PMEGP official website.

- Step 2. Find the section with registered applicants.

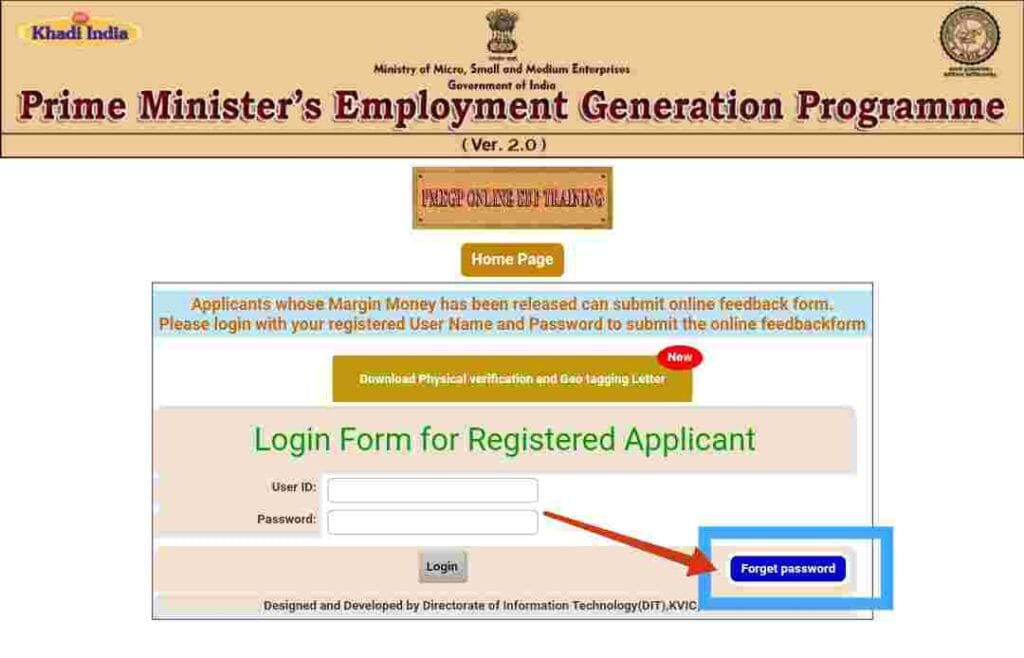

- Step 3. A login form will appear: This is the “Login Form for Registered Applicant.”

- Step 4. Fill in your User ID and password into the respective boxes.

- Step 5. Click on the “Login” button to allow you to enter the site.

- Step 6. If you’ve lost your password, please just click “Forgot Password” to reset it.

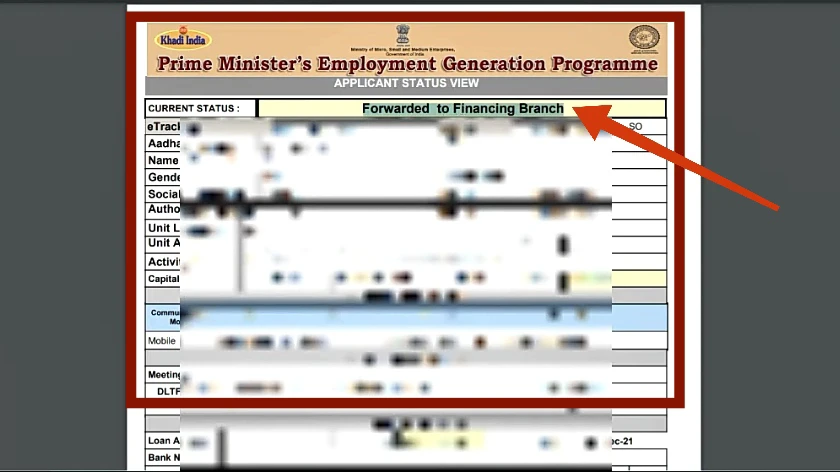

- Step 7. After successfully logging in, look for the “View Status” option and click on it.

- Step 8. You can now check the current status of your PMEGP loan application.

By following these steps, you can easily track your PMEGP application and keep close tabs on its progress.

FAQ’s – About PMEGP Loan Application

Disclaimer

Please Note That Pmegploanapply.Online Is Not The Official Portal For The Pradhan Mantri Employment Generation Programme (PMEGP) Or Any Related Government Scheme Lesed By The Organization Of The PMEGP Itself. The Contents Posted On This Website Are Of Non-Governmental Nature And Are Derived From The Government Organizations.

For Official Information, Visit The Correct Government Of India Regular Portal At Https://Kviconline.Gov.In